Top Tips

Why the Mental Health and Money Advice service is helping people with mental illness and money issues

At the Mental Health and Money Advice service, we acknowledge the need to support people who are affected by mental health and money problems. And we are determined to offer help and support to those in need.

What is the connection between mental illness and money problems

One in four people are affected by a mental health condition, and, of these close to four million will struggle financially. In addition, a further four million people are at risk of developing a mental illness as a direct result of their financial situation.

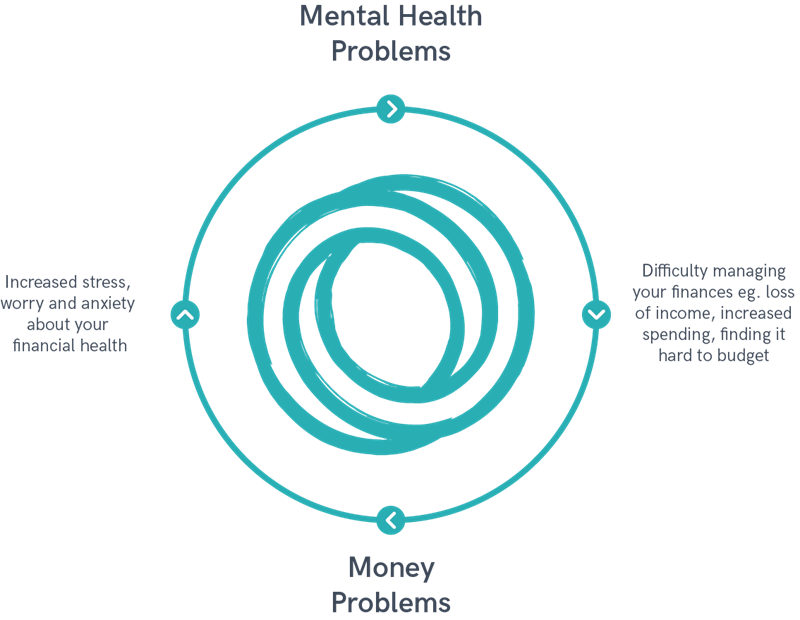

With a lack of support, money issues combined with a mental illness can create a vicious cycle. At its worst, this can lead to spiraling debt, family problems and homelessness.

One of the main concerns for a lot of people living with a mental health condition and money issues is the UK benefits system.

Many find the benefits system complicated and emotionally draining. When communicating with people with a mental health condition, it’s clear that the benefits process simply can’t assess the complexities of what living with a mental health condition means.

How the Mental Health and Money Advice service can help you

Here at the Mental Health and Money Advice service, our website is designed specifically to offer concise and impartial advice to people experiencing both mental health and financial difficulties.

We provide free information and support through our easy to use knowledge base for anyone affected by these matters including carers, family members and, industry professionals.

The website offers detailed advice on a range of topics including:

- We offer expert advice on the most common mental health and money related issues such as welfare benefits, managing money and debt and mental health care and treatment.

- Free tools and calculators to help you manage your money better.

- To help you deal with money issues we have created a range of sample letters and templates that can be used to contact healthcare professionals, organisations and, creditors.

- We have many first-person real-life stories where people in similar positions explain how they have overcome their mental health and money problems.

- For each area of advice, we provide a list of useful contacts just in case you require more detailed guidance.

"We also have a small team of dedicated mental health and money advice specialists who offer one-to-one advice and casework over the telephone."

One-to-one advice service

We also have a small team of dedicated mental health and money advice specialists who offer one-to-one advice and casework over the telephone.

We are currently only available to all online, access to our advice line is by referral only via our founding charity in Northern Ireland, Mindwise.

- Mindwise (Northern Ireland): 028 9040 2323

Additionally, there are 2 referral partners who you can contact for support and they can also refer you to our advice service should you meet the eligibility criteria.

- StepChange: 0800 138 1111

- Money Helper: 0800 011 3797

For further support take a look at the Help & Contacts section of our website. This will give you easy access to other trusted organisations that can offer specific advice related to either mental health or money issues.